As a general rule I seldom proclaim statements such as, “It’s a great time to buy a home!”, or “There’s never been a better time to buy!” Sure, when Facebook and blogging were the new shiny objects of the world I may have done it a few times. After a few weeks/months, however, I pulled back. Don’t get me wrong, I’ll market and advertise listings and the Team all day long, but I never want to be “salesman(y)” to clients and/or potential clients, and therefore usually lay off such statements.

As a general rule I seldom proclaim statements such as, “It’s a great time to buy a home!”, or “There’s never been a better time to buy!” Sure, when Facebook and blogging were the new shiny objects of the world I may have done it a few times. After a few weeks/months, however, I pulled back. Don’t get me wrong, I’ll market and advertise listings and the Team all day long, but I never want to be “salesman(y)” to clients and/or potential clients, and therefore usually lay off such statements.

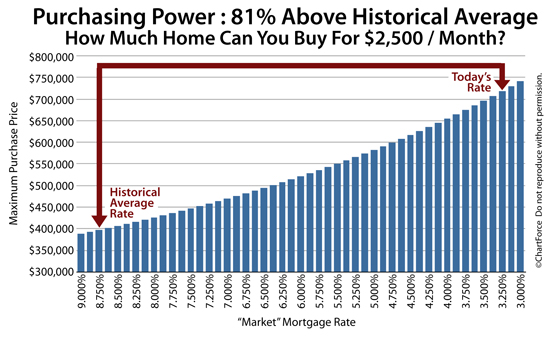

That said, the chart above is pretty cool and is a great snapshot of today’s opportunity. It’s a good illustration of the buying power, due to current interest rates, that purchasers have in today’s real estate market. It shows unprecedented purchasing power.

As I speak with clients, the conversation usually leads to something like, “The buyer that could afford a $200,000 home last year can afford a $250,000 home today.” Obviously, if I’m speaking with a seller we talk about how this expands the potential buyer pool should the potential seller decide to put their home on the market. According to the chart above, I need to expand on my price-spread illustration.. A LOT.

Now, back to the more important picture and what I’m really getting at. If my buyers can afford a $2,500 monthly payment (using the scale above), it does NOT mean I’d coach them to purchase the $710,000 price level the arrow above is pointing to. When representing buyers, one thought is always in the back of my head; “If something bad happens (job loss, sickness, divorce, etc), can I get them out of this house?” If the answer is, “No,” I tap the brakes and let them know it.

To sum up, don’t go load up on a monster house simply because you can afford the payment. Payments notwithstanding, price points are important,too, and the top level of the price points are different in every market. In short, $2,500/month may be able to buy a $710,000 house anywhere in the country, but the $710,000 house in Washington, D.C. or Boca Raton, FL is quite different than a $710,000 in our Columbia, S.C.’s market.

Whether your comfort level is $10,000 or $10bazillion, call or email fjones@cbunited.com or amandaqpayne@live.com. Amanda and I are proud to disclose/discuss our knowledge of the balance between the power of today’s interest rates as they relate to Columbia, S.C.’s price points.

Thanks to lender friend Nathan Ballentine for posting the chart on Facebook. While I don’t agree with everything in the link, the bar graph is a great snapshot of the power of interest rates.

FJ

Speak Your Mind